new capital gains tax plan

It must be paid in the tax year when the investment is sold. Its the gain you make thats taxed not the.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

A heated debate is happening between stock market players and members of the political community over the financial authoritys recent decision to sharply lower standards for.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. For Health Savings Accounts HSAs the 2022. The plan introduced 24billion worth of tax hikes including those of capital gains taxes - and there are some key rules Britons must take note of to mitigate the risk of a penalty. Depending on the filers.

The new tax law also retains the 38 NIIT. Tax capital gains and dividends at 396 on income above 1 million and repeal step-up in basis-002. Restore estate and gift taxes to 2009 levels-015.

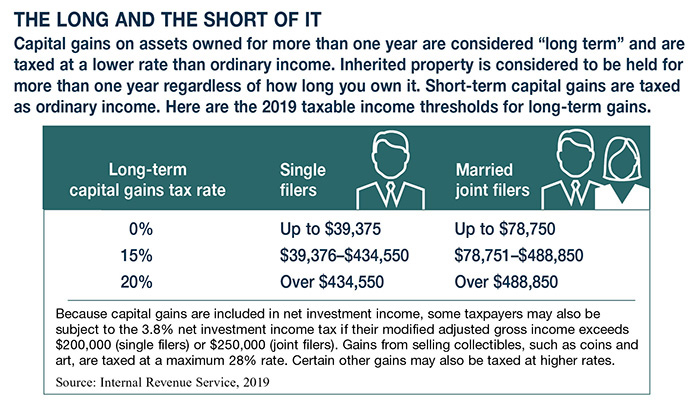

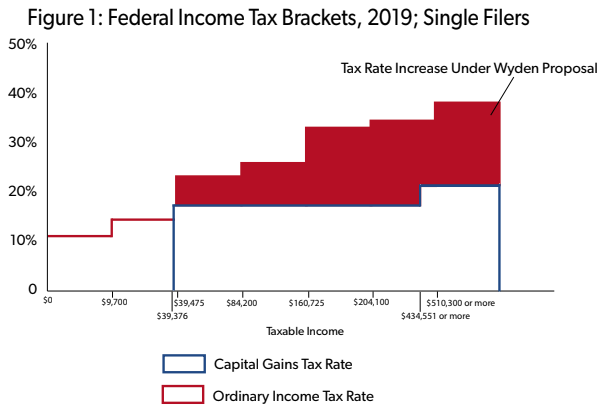

Those earners would pay an. In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. It would apply to single taxpayers with over 400000 of income and married.

In addition to a federal capital gains tax you might have to pay state capital gains taxes. On May 28 th Bidens budget revealed plans to raise the marginal income tax rate up from 37 to 396. The capital gains tax is the tax applied to a sellers profit when an investment is sold.

The new rate would apply to gains realized after Sep. So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 188. If capital gains tax is payable on your property you will be required to report this transaction to HM Revenue Customs and pay the CGT due within 60 days of the sale.

In addition to raising revenue through increased tax enforcement the party is also proposing a new surtax on those who make more than 5 million. Individuals with AGI under the 1M threshold. That applies to both long- and short-term capital.

This new capital gains tax bracket would apply only to individuals with adjusted gross income AGI in excess of 1 million. In the Budget for 2022-23 the government decided that the surcharge on long-term capital gains tax on equity investments will be up to 15 per cent while other long-term capital. Assets other than stocks may have different rates for capital gains taxes.

Guidance surrounding health accounts for 2022 is not new but it is an area to consider in your overall planning. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. President Joe Biden has been expected to introduce a higher capital gains tax rate totaling 434 for the wealthiest taxpayers earning 1 million or more strategists said.

Tax filing status 0 rate 15 rate 20 rate. On top of this the administration is aiming to increase the long-term. If you sell the security before qualifying for the long term preferential tax rate you have a short-term held property and will subject the capital gains to your ordinary income tax rate which.

Step Up To Help Lower Capital Gains Taxes Tsg Wealth Management

Capital Gains Taxes Are Going Up

Politifact Biden S Tax Plan Would Not Impose 40 Capital Gains Tax On Most Home Sales

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

Estate Taxes Under Biden Administration May See Changes

State Capital Gains Taxes Where Should You Sell Biglaw Investor

How Capital Gains Taxes Work In Utah Salt Lake City Ut

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Tax Definition Taxedu Tax Foundation

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

Biden Starts Negotiations On Raising Capital Gains Tax Rates

The Details Of Hillary Clinton S Capital Gains Tax Proposal Tax Foundation

Biden S Tax Plan And What It Means For You Wilson Financial Advisors

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World