japan corporate tax rate history

Inhabitants tax local income tax. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Tax Base Tax Rate. A Look at the Markets.

Japan Corporate Tax Rate chart historic and current data. The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of. Corporation tax Hojin zei.

National Income Tax Rates. Instead it happened a. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen.

10 Year Treasury Rate. Japan Corporate Tax Rate History. The trend in after-tax corporate profits as a percentage of national income.

Taxes imposed in Japan on income derived from corporate. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Current Japan Corporate Tax Rate is 4740.

Japan Corporate Tax Rate table by year historic and current data. 5 rows 73 51 73 53 Over JPY 8 million. Gold Analysis Twist Could Cause Inflation to Challenge 133 Not Seen Since.

Japan corporate tax rate history Monday June 20 2022 Edit. In the case the amount of pretax profit zeibikimae Junrieki 税引前純利益 is 1 million yen. The present corporate taxation level will vary from 15 up to 232 on the annual net business income of the company.

Corporate taxes in 2010 did not actually take place in the United States. Tax rates vary and depend on the amount of property or assets received. Corporate Tax Rate in Japan averaged 4083 percent from.

Japan corporate tax rate history Saturday June 25 2022 Edit. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. December 23 2010.

Tokyo One-Stop Business Establishment Center. Taxable income over 10 million. The special local corporate tax rate is 4142 and is.

Japanese Inheritance Tax 2021. This page provides -. Calculation of corporation tax in Japan.

Outline of Corporation Income Tax PDF316 KB Guidelines for Notification of Corporation Establishment etc. Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent. One of the biggest stories impacting US.

Current Japan Corporate Tax Rate is 4740. S. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer.

The total tax burden for corporations will vary between 2246 up to a.

Portugal Corporate Tax Rate 2022 Data 2023 Forecast 1981 2021 Historical Chart

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

How Do Us Taxes Compare Internationally Tax Policy Center

France Corporate Tax Rate 2022 Data 2023 Forecast 1981 2021 Historical Chart

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

Global Corporate And Withholding Tax Rates Tax Deloitte

Taxing The Rich The New York Times

Real Estate Related Taxes And Fees In Japan

Japanese Corporate Tax At A Glance In Bullet Points

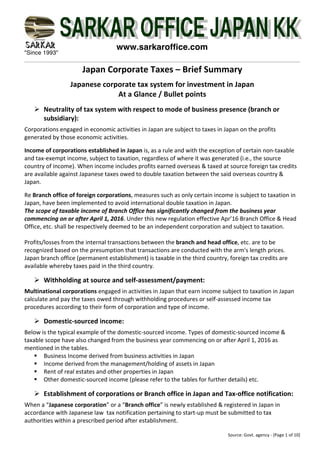

Japan Tax Reform 2016 Japan Industry News

Corporate Tax Rates Around The World Tax Foundation

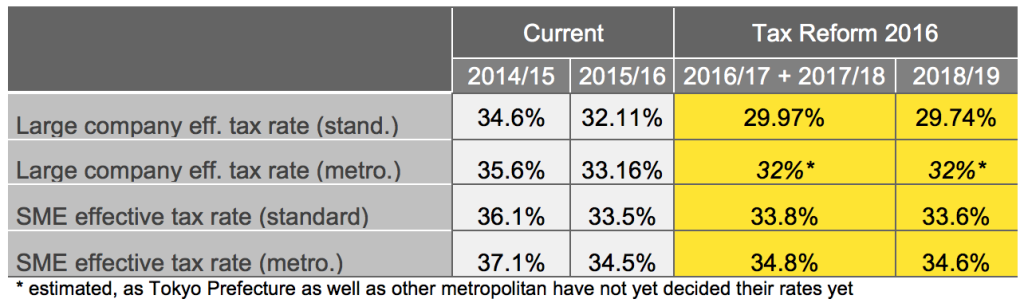

The U S Is One Of The Least Taxed Developed Countries Itep

How Do Us Taxes Compare Internationally Tax Policy Center

A Guide To Corporate Taxes In Japan Japan Tax Guide Tomaコンサルタンツグループ

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Japan Further Discusses Lowering Their Corporate Rate Tax Foundation

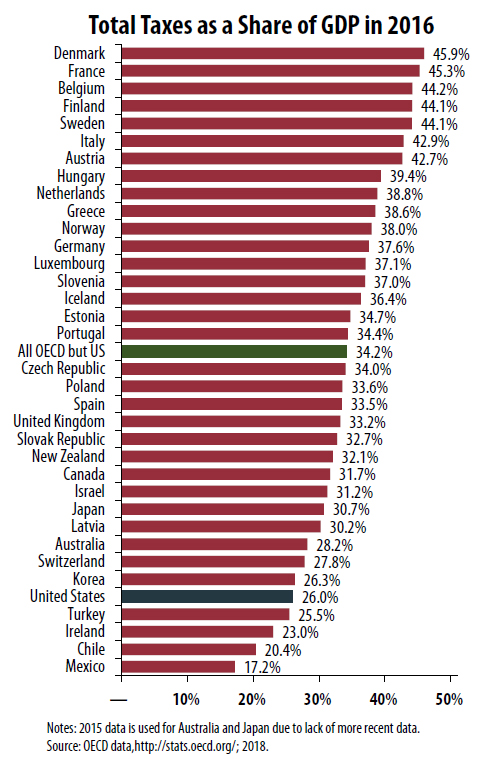

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday